Navigating Rates

The decline of US exceptionalism in Asia?

As the world’s largest net creditor, we think Asia is uniquely positioned to lead the next wave of capital diversification amid a waning belief in US exceptionalism.

Key takeaways

- Foreign exchange volatility, erratic policymaking in the US and the rise in intra-Asian trade are prompting Asian investors to question the long-term dominance of the US dollar as the anchor currency in the region.

- As the region with the largest gross international investment position, of which 41% is invested in the US, Asia has the potential to influence significant investment flows.

- The renminbi, which is increasingly used in regional cross-border trade, stands to gain from any regional dedollarisation. We think Chinese government bonds are an increasingly credible alternative to US Treasuries.

Outsized moves in the Taiwan dollar and Singapore dollar in May and June took markets by surprise. Historically, even low-volatility Asian currencies such as these tend to weaken, not strengthen, against the US dollar during risk-off periods – a reflection of crucial trade ties with the US. Yet this time it was different. In Taiwan, the abrupt moves reportedly erased nearly two years of operating profit for major insurance investors.

The news followed the outcome of JP Morgan’s Spring 2025 investor survey,1 conducted during its annual seminar alongside the IMF-World Bank meetings. The results marked a divergence in macro outlook between US and non-US investors. US-based investors largely saw current disruptions as transitory, expecting a return to “US exceptionalism” – the belief in the global dominance of the US dollar and the safety of US dollar assets. In contrast, non-US investors viewed recent events as structural shifts, indicating a broader change in worldview.

In our view, these are signals that the longstanding narrative of US exceptionalism is weakening. Amid persistent fiscal deficits and shifting geopolitical alliances, global investors are reassessing their concentration of risk in US assets. In this evolving landscape, we think Asian bonds, especially in local currency, are growing increasingly credible as a destination for capital diversification.

What if the US dollar were to lose its safe-haven status in Asia?

Asian attitudes towards the US dollar matter because Asian countries have been significant holders of dollar assets for three decades and longer.

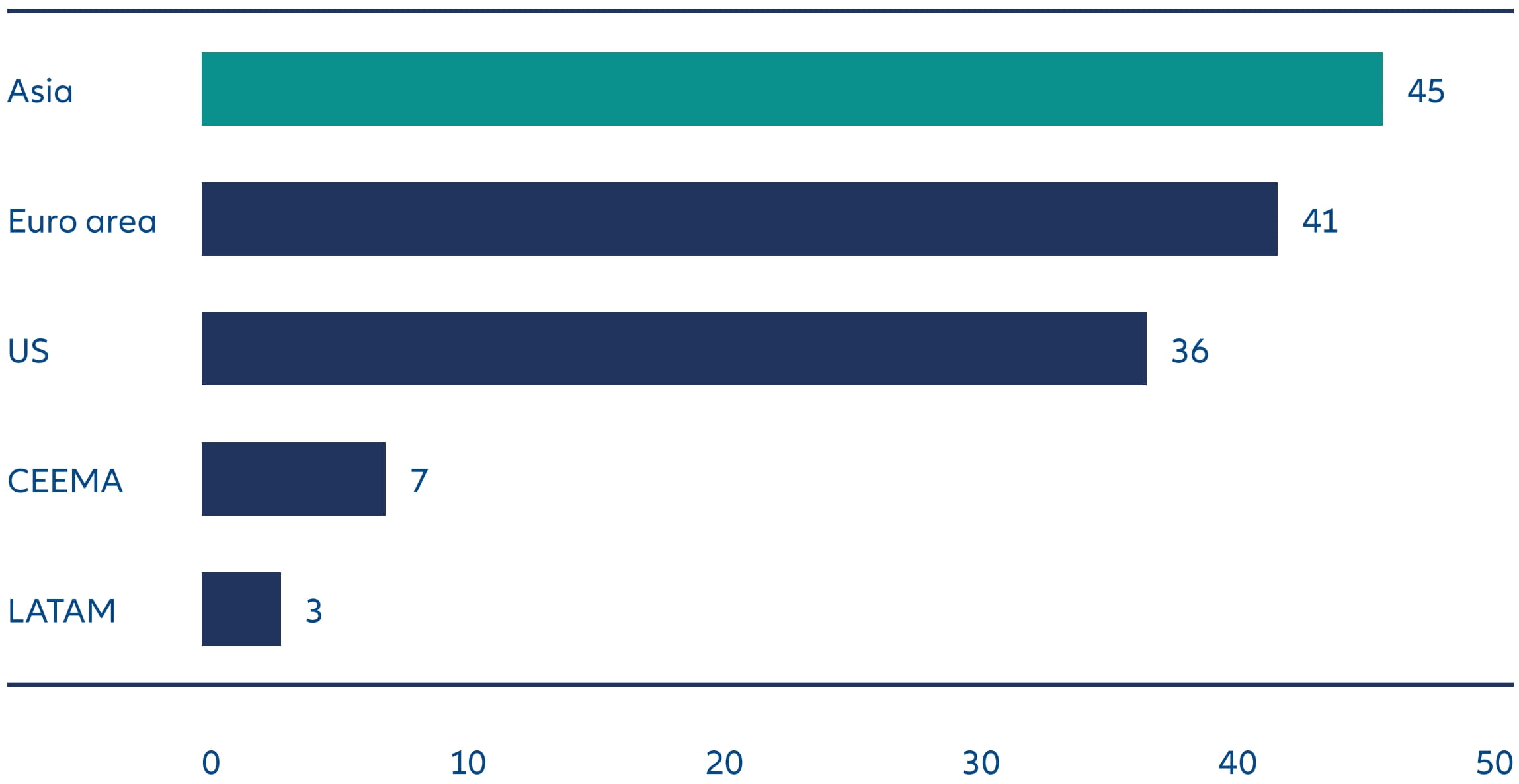

Drawing from the lessons of the Asian Financial Crisis of 1997, Asian policymakers embarked on export-oriented growth models, supported by undervalued currencies, while funding investments with high levels of domestic savings. Persistent current account surpluses propelled Asia to become the region with the largest gross international investment position (Exhibit 1).

Exhibit 1: Asia’s international investment position (USD trillions)

Source: Morgan Stanley Research, Allianz Global Investors as of 27 May 2025.

Of Asia’s international holdings, a colossal 41% is invested in the US.2 If Asian investors were to reduce this allocation, the scale of the investment flows could be vast.

That prospect no longer seems farfetched. Once viewed as a risk-free currency, the US dollar has, of late, exhibited behaviour more akin to a risky asset, making the currency a potentially less attractive option for Asian investors to park their excess savings. While the dollar’s dominance will not fade overnight, there are growing signs that Asian investors are rethinking their approach.

High conviction investment ideas from our Asia fixed income team

Foreign exchange: We are overweight the Korean won, Malaysian ringgit and Indonesian rupiah and positioned short the US dollar. We are looking to increase these positions on the back of selloffs.

Duration: We are broadly positive on Asia bond duration, including Indonesia and Malaysia, given the increased space for monetary policy and conducive growth-inflation dynamics. We have a neutral position in some markets for valuation reasons.

Credit: For Asian investment grade bonds, we are slightly long credit spread risk. For Asian high yield bonds, we remain long carry and expect security selection to be the key long-term positive contributor. We look to increase credit beta on the back of global-induced selloffs.

How might investors play the dedollarisation trend?

One short-term impact of this trend is likely to be a rise in currency hedging. Economies with substantial unhedged US dollar exposure are reassessing their approach to foreign exchange risk – the recent experience of Taiwan’s life insurance companies offering a cautionary tale.

Currency hedging is useful because it allows investors to lower their exposure to dollar volatility without necessarily selling their underlying holdings. However, we think that in the medium to long term, many Asian investors will go further and diversify away from some of their US dollar holdings.

One approach is to consider swapping US Treasuries for Asian government bonds denominated in local currency. The region offers a diversified mix of sovereign bonds, ranging from the credit strength of AAA-rated markets like Singapore and Australia to the growth potential of investment-grade economies such as India and Indonesia.

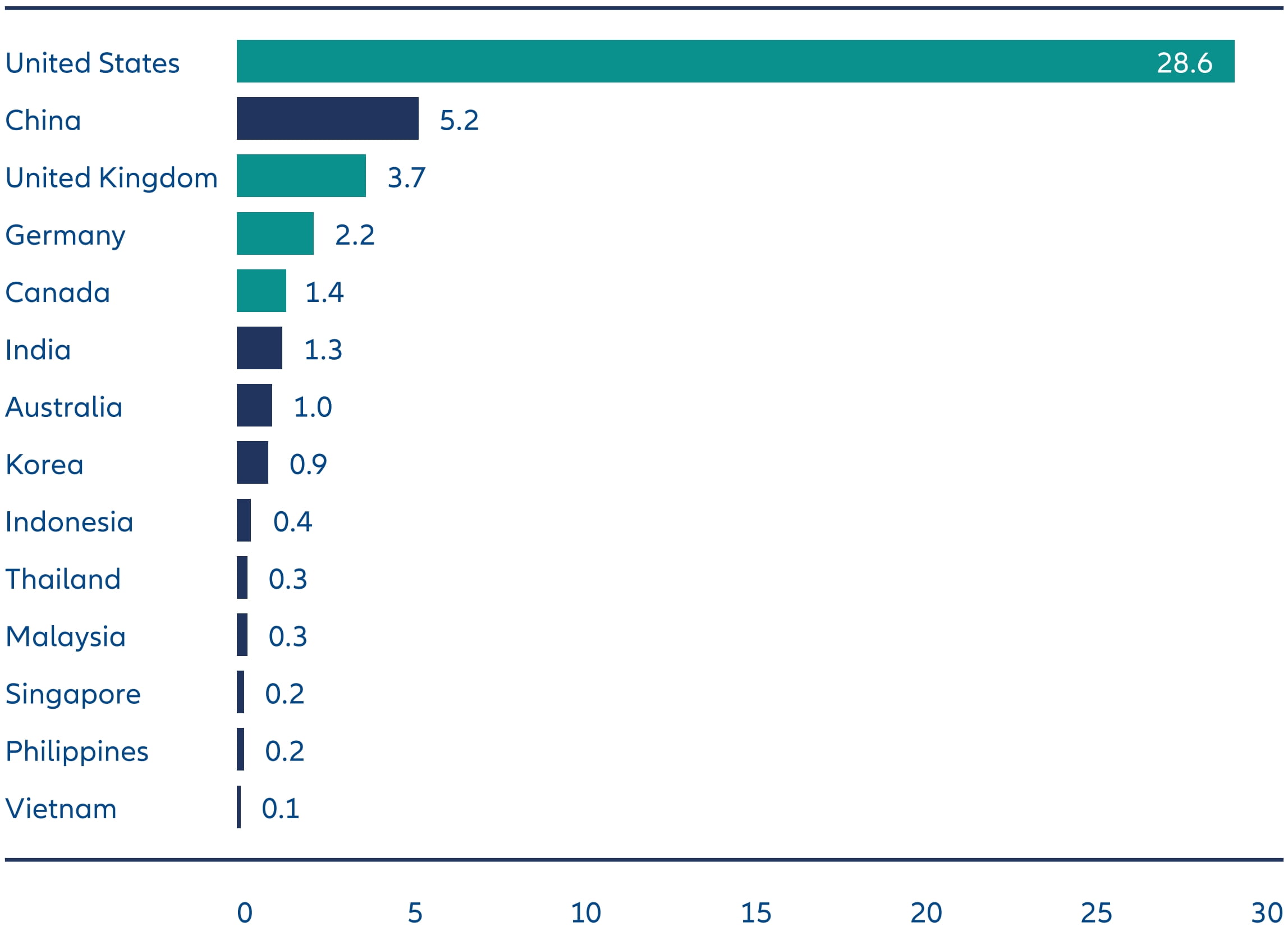

Asia’s government bond markets are still small compared with the US – and, with the exception of China, to the UK, Germany and Canada (see Exhibit 2). But, with GDP growth rates in Asia outstripping those in Europe and North America, we expect the gap to narrow over time, creating a bigger market for investors to access. We have seen about USD 60 billion inflows into Asia ex-China local currency bond markets over the past three years, and there is room for more.

Exhibit 2: Size of government bond markets (USD trillions)

Source: WIND, SIFMA, United Kingdom Debt Management Office Statistics Canada, Deutsche Finanzagentur, Reserve Bank of Australia, Bloomberg, Allianz Global Investors, as of 9 June 2025.

The incoming capital flows would continue the virtuous cycle in Asia, where capital inflows and economic growth reinforce each other to reprice local currency assets.

Moreover, we would argue that the job of central banks across Asian countries is getting easier by the day in a global macro environment with a weaker US dollar, lower energy prices, benign food inflation and China’s policymakers taking steps to stimulate domestic consumption. We think that, should there be a global slowdown, Asian central banks would be able to cut policy rates more aggressively than markets anticipate – without worrying about capital outflows or imported inflation. This backdrop is very supportive for Asian sovereign local currency bonds.

A decline in the dollar could make way for the renminbi

As the influence of the US in Asia comes into question, China’s power – both political and economic – continues to rise, and that, in turn, supports the growing importance of China’s currency.

This is happening alongside growth in intra-Asian trade, of which China is an important engine. In 2020, the Association of Southeast Asian Nations (ASEAN), a group of 10 states including Indonesia, Thailand and Vietnam, overtook the European Union as China’s leading trading partner. In 2023, China accounted for nearly 20% of total ASEAN trade.3

This deepening of regional trade ties accompanies the rising use of the renminbi in cross-border payments, which China has supported by establishing renminbi clearing banks, cross-border settlement infrastructure, and broader access to China’s domestic capital markets. Together, these measures contribute to a more developed renminbi ecosystem capable of supporting central banks’ reserve diversification strategies.

We would argue that Chinese government bonds are becoming an increasingly credible alternative to US Treasuries for Asian investors. Indeed, long-term analysis shows they have outperformed both Treasuries and German Bunds over the past decade (Exhibit 3). That performance comes alongside a relatively low correlation with other corporate and sovereign bonds, suggesting that these assets have substantial diversification benefits.

Exhibit 3: Chinese government bonds outperformed Treasuries and Bunds over the past 10 years

Source: Bloomberg, AllianzGI as of 25 April 2025.

As Pan Gongsheng, Governor of the People’s Bank of China, pointed out in the recent Lujiazui Forum, the global monetary system is moving towards multi-polarisation as investors look to diversify their investment allocations away from the US dollar. We think it is inevitable that the renminbi will become more important as one of the major anchor currencies in the region over the long term. Thus, we believe it makes sense for long-term investors to explore renminbi-denominated assets such as Chinese government bonds in the years ahead.

Asia is better able to survive trade wars than in the past

The trends pointing towards dedollarisation in Asia are the same ones that have bolstered the region during the recent trade wars initiated by the US.

Compared with the previous tariff cycle imposed during Donald Trump’s first presidency, most Asian economies now benefit from diversified trade relationships with multiple trading partners. The deepening of intraregional trade flows reinforces longer term economic resilience and growth prospects for Asia, reducing the region’s dependence on the growth trajectory of countries in Europe and North America.

Most Asian economies have also either maintained or strengthened their macroeconomic buffers, including larger foreign exchange reserves and improved current account positions.

The implication is that it is different this time. Asia is more resilient and less dependent on its trade with the US. That supports the investment case for diversifying into Asian local currency bonds, as well as for exploring other assets, such as Asian corporate bonds, which can diversify country-of-risk exposures even where such assets are USD-denominated.

As the world moves toward a more multi-polar structure, in which the US is no longer the unrivalled superpower, Asian currencies – especially the renminbi – are becoming important alternative options for investors in search of diversification. We think this trend has only just begun.

1 JP Morgan, as at 29 April 2025.

2 Morgan Stanley Research, Allianz Global Investors, as at 27 May 2025.

3 China Ministry of Commerce, McKinsey & Co, as at 3 September 2024.