Navigating Rates

Payouts and Policy: why European dividends matter in an uncertain global landscape

European stock markets are expected to remain highly volatile in the second half of 2025, driven by a mix of geopolitical and economic uncertainties. In addition to persistent tensions in Asia and Europe, the recent escalation of the Iran conflict has introduced new risks to global stability. Concerns around energy supplies and trade routes have intensified market nervousness.

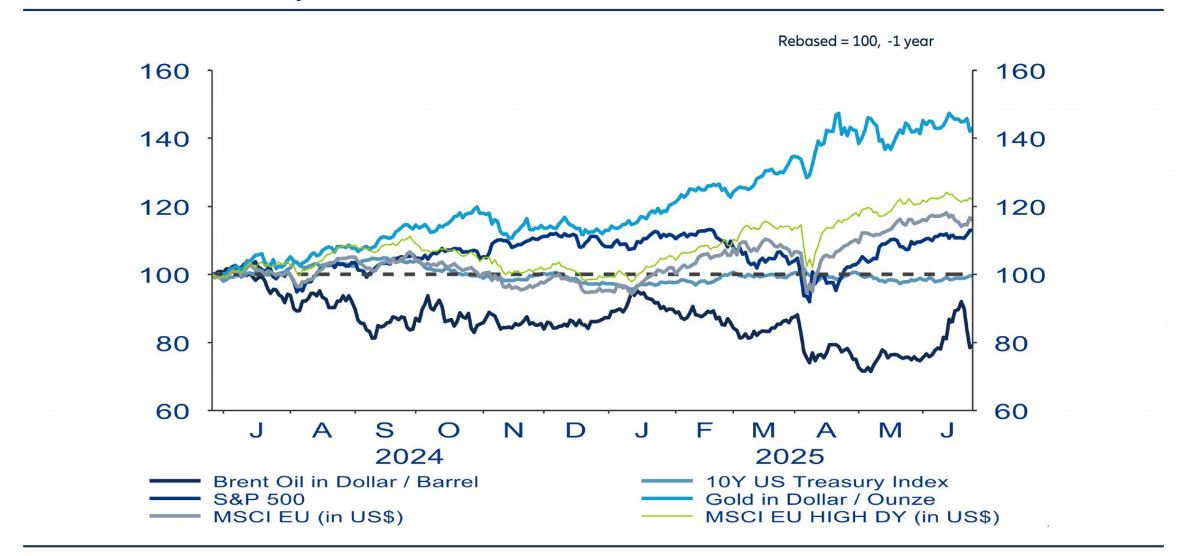

Exhibit 1: Market uncertainty has increased since mid-2024

Source: LSEG Datastream, AllianzGI Global Capital Markets & Thematic Research 26 June 2025

These developments are compounding a fragile investor sentiment. Political uncertainty in the United States, particularly due to the unpredictable trade policies under President Trump, has already contributed significantly to global unease.

Between mid-2024 and mid-2025, market uncertainty experienced a notable increase. This period was marked by heightened volatility driven by a combination of economic shifts, geopolitical tensions, and evolving monetary policies. Commodities such as oil and gold experienced sharp fluctuations, and the S&P 500 also showed significant volatility.

In June this year, Israel’s attack on Iran resulted in a further surge in gold and oil prices. This demonstrates how quickly markets react to political headlines. The MSCI Europe as well as the S&P500 Index oscillated between brief recoveries and abrupt setbacks over the year, albeit the European index did so with less intensity. This reflects investors’ stance on the current attractiveness of the European market and the relative confidence in the political environment in Europe.

Note, too, that the MSCI Europe High Dividend Index showed an even better performance with less volatility, underscoring the defensive nature of companies with strong dividend profiles. These companies typically have solid fundamentals and consistent cash flows, making them more resilient in times of geopolitical tensions and economic stress. Moreover companies with a reliable dividend policy usually have strong balance sheets and robust business models. Their ability to maintain their payouts even under difficult conditions strengthens investor confidence and offers a degree of protection against market turbulence. In this climate, high-dividend companies are gaining relative attractiveness for investors in search of more stability.

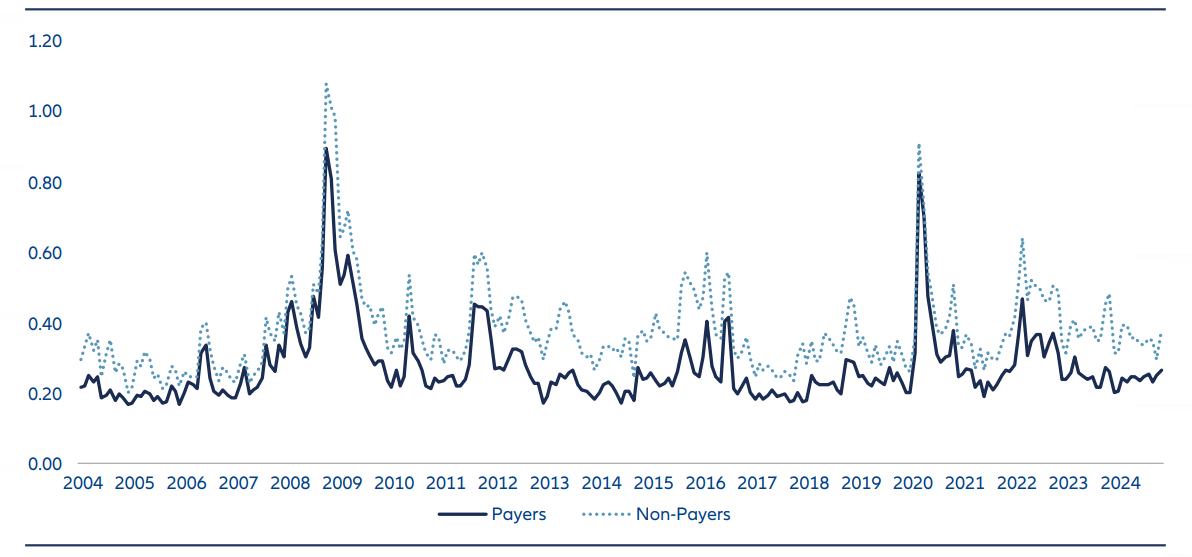

A historical review of volatility data confirms this. On average, dividend-paying companies in the STOXX Europe 600 index exhibit significantly lower price fluctuations than companies without regular distributions. Furthermore, companies that pay dividends even in times of crisis send a strong signal to the market. They stand for financial stability and reliability – qualities that investors particularly value in a volatile environment.

Exhibit 2: Volatility of dividend payers is lower than for non-dividend paying companies (STOXX Europe 600)

Equally weighted 30-day volatility of dividend payers and non-payers, respectively.

Source: LSEG Datastream, Allianz Global Investors Global Capital Markets & Thematic Research. Past performance does not predict future returns.

Data as of December 2024.

Why Europe? Fundamental strength meets structural change

In addition to Europe’s long-standing position as the region with the highest average dividend yields (averaging 3.4% over the past two decades), European equity markets, as measured by the MSCI Europe Index, delivered a comparatively stable performance in 2025, especially when contrasted with the more volatile U.S. market represented by the S&P 500, and this despite ongoing global challenges. A comprehensive economic stimulus package from China including infrastructure investment, monetary easing and support for domestic demand has strengthened the competitiveness of European exporters and bolstered markets.

Furthermore, Europe is in the midst of a profound structural transformation. The European Union has launched large-scale investment initiatives in the areas of defence and infrastructure. Germany is shifting away from its traditionally restrictive fiscal stance by launching a €500 billion credit-financed infrastructure program, as part of a broader investment initiative aimed at strengthening the country’s long-term competitiveness1 . The United Kingdom is also sending a strong signal with its ten-year infrastructure strategy. Up to £775 billion2 is to be invested in transport, energy networks, housing and digital infrastructure, accompanied by accelerated approval procedures to promote growth and sustainability.

On 25 June 2025, NATO members further agreed to increase their spending on defence and related infrastructure to 5% p.a. by 2035, a commitment that is further bound to transform Europe in the coming decade. These large-scale fiscal investments are expected to have a measurable impact on Europe’s gross domestic product (GDP) – stimulating short-term demand and, more importantly, enhancing long-term productive capacity through a sustained multiplier effect. In an uncertain global environment, they can thus act as a stabilising driver of growth.

These developments are not only creating new economic momentum, but also strengthening the fundamentals of many European companies.

Substance, stability and prospects

In an uncertain market environment, dividend stocks offer a reliable blend of defensive strength, consistent income and long-term growth potential. Europe is attractive not only due to its appealing yields, but also thanks to structural reforms and fiscal support. European dividend stocks currently offer compelling option for investors who value substance and sustainability, offering a blend of resilience, reliable returns and exposure to companies driving the transition towards a more sustainable and future-ready economy.

1 Deutscher Bundestag, Gesetzentwurf für ein steuerliches Investitionssofortprogramm zur Stärkung des Wirtschaftsstandorts Deutschland,

Drucksache 21/643, 25 June 2025

2 UK Government, UK Infrastructure: A 10 Year Strategy – GOV.UK 19 June 2025