Active is: Striving forward in a changing world

It’s time to rethink our DC offerings for better and sustainable outcome

Summary

How do we define a good Defined Contribution (DC) offering? Some believe a good DC scheme refers to numerous investment options, while others believe it should have passive funds with low investment costs. Allianz Global Investors believes the most important mission for a DC scheme is to “offer investment options with good purpose”.

Key takeaways

|

Although DC schemes have existed in the Hong Kong market for more than 20 years, the range and type of the investment options remains fairly standard. Most of the existing DC fund choices are equity and/or bond focused and put capital appreciation as their primary investment objective. These products may serve the purpose if the majority of the members are in an accumulation phase.

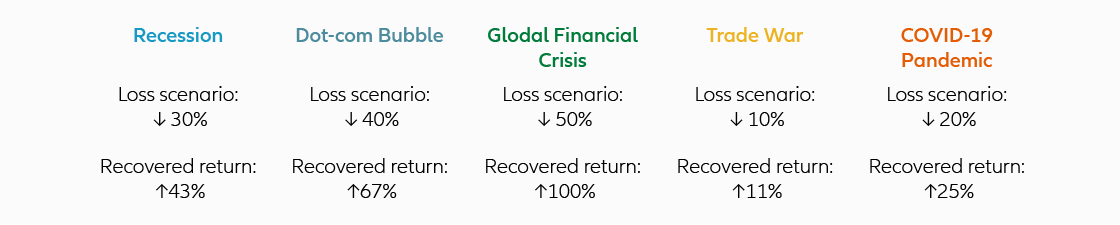

In fact, Allianz Global Investors finds that there is a need for the market to reconsider the primary objectives of accumulation phase DC products. Apart from their conventional investment goals such as capital growth and yield generation, individuals should be aware that risk management and downside protection are increasingly important. Market downside may lead to a significant loss for their retirement savings. For example, a fund needs to deliver an investment return of 25% to cover a 20% market loss. It’s noteworthy that the time for market recovery is much longer than the period of a market clash.

Figure 1 indicates that market volatility is an “enemy” for individuals trying to achieve their saving objective. As such, DC investment options should be designed with better diversification to mitigate the fallout of market downside.

In addition, given that a decumulation investment product’s primary objective generally focuses on “meeting retirees’ regular expenses”, a capital appreciation-oriented product may not be able to meet the criteria. As such, we suggest individual savers should manage their wealth more prudently during their decumulation phase in order to meet their retirement needs.

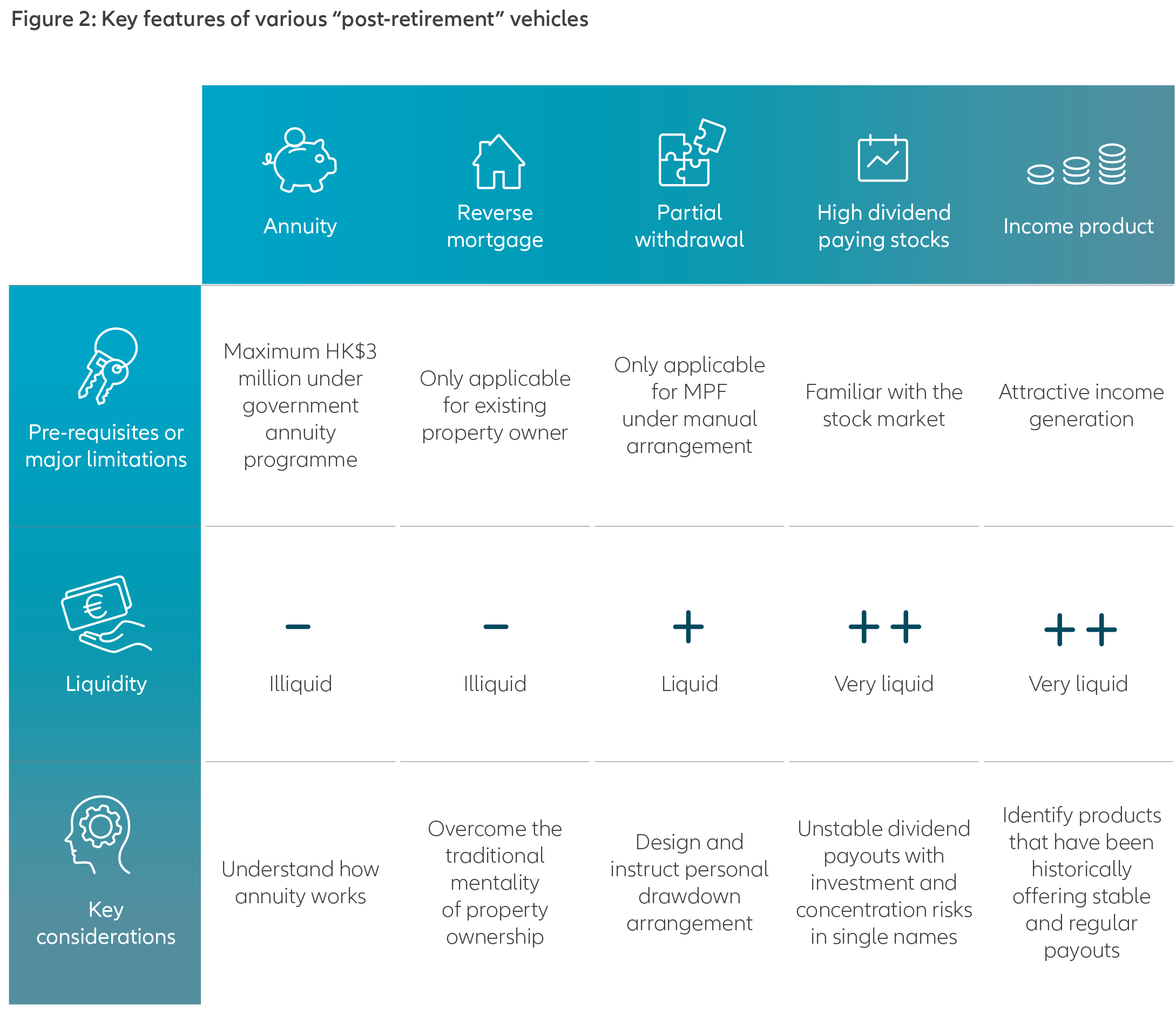

Although there are various types of post-retirement vehicles available in the market, it remains uncertain whether individual savers can fully understand their specific features, and how these products help address their post-retirement investment needs.

The underlying idea of DC may sound simple as it only requires members to contribute and invest. However, members need to take investment responsibility through their saving and retirement journey, while industry players also need to provide members with fit-for-purpose offerings.

In the following sections, we will share our thoughts on how we could make DC offerings better for individuals across the accumulation and decumulation phases.

True diversification for accumulation phase

As for the accumulation phase, we believe individuals need to have an investment solution that offers exposure across various asset classes, as well as within an individual asset class.

A solution without such characteristics would lack the diversification benefit that helps individuals weather challenging market conditions over their saving journey. In short, an appropriate investment option should be featured with multiple drivers for higher potential returns and better mitigation of risks.

The existing DC lifestyle funds only diversify their portfolios across equities and bonds, but we believe a “true” portfolio diversification is more sophisticated than that.

Taking a balanced fund as an example, it typically allocates 70% total assets to equities and 30% to fixed income across various markets, sectors and size of companies. This portfolio allocation may look diversified to individuals, but the key question is whether the fund can practically optimise diversity.

We believe such a portfolio still has room for improvement. We suggest incorporating alpha and beta exposure in its portfolio, which requires (1) clear segregation of styles within each asset class, and (2) dedicated exposure of active and passive strategies for different market cycles.

This structure is aimed at capturing alpha-generating opportunities and reducing the fund’s sensitivity to individual asset classes, which can provide better diversification benefits to individuals.

We also observe that the markets have favoured single asset class or investment style over the past few years. To avoid over reliance on a single factor, it is essential for a retirement product to incorporate multiple return drivers in a portfolio, otherwise, the product may fail to deliver a consistent and stable return.

For the accumulation phase, individuals need to have an investment solution that offers exposure across various asset classes, as well as within an individual asset class. It is essential for a retirement product to incorporate multiple return drivers in a portfolio, otherwise, the product may fail to deliver a consistent and stable return.

In decumulation phase, retirement products that can generate stable cash flows become increasingly important for post-retirement life particularly as individual savers may face different types of risks, such as inflation, longevity and investment risks.

Income-focused funds under decumulation phase

In addition, retirement products that can generate stable cash flows become increasingly important for post-retirement life particularly as individual savers may face different types of risks, such as inflation, longevity and investment risks, in their decumulation phase.

An annuity product may fit the bill in this context, although it is a fairly new concept and individuals may not yet find the product appealing. Under the current low interest rate environment, individuals do embrace products featuring regular income payouts.

We believe individuals should not be too complacent about their retirement savings as the decumulation phase may last for 20 years or more due to increasing life expectancy. They should be more aware of the importance of income generation during their post-retirement life, otherwise their wealth may be eaten up by inflation and exposed to longevity risk.

Overall, there is no one-size-fits-all solution for longevity risk in the market, but we believe “income product” is an appealing option as it is easy to understand and implement for individual savers.

With the current scarcity of income-oriented products in the DC space, some retirees would have to create a high dividend stock portfolio to generate regular income. However, this approach could increase exposure to concentration risk if the holdings are of a single type of asset.

Instead, they should invest in a diversified income product that can offer regular income payouts. These products could offer a higher-than-expected dividend yield on a regular basis, which would allow retirees to draw down the income payout for their retirement expenses.

Let’s consider the scenario of a retiree with assets of HK$2 million but no income. How can he or she support his or her monthly expenses by allocating part of the assets in an income fund?

A sustainable retirement journey

It’s indeed a challenging task to ask individual savers to make informed decision over a long investment horizon when they face different types of risks throughout their retirement saving journey.

We believe a truly diversified product can help them generate returns over various market cycles with better risk control. Individuals may take advantage of such products for better investment outcomes during the accumulation phase. More importantly, an income-focused product can provide individuals with a sustainable source of income and flexibility in investment management during their decumulation phase, helping them meet their retirement needs without undue problems.

> download