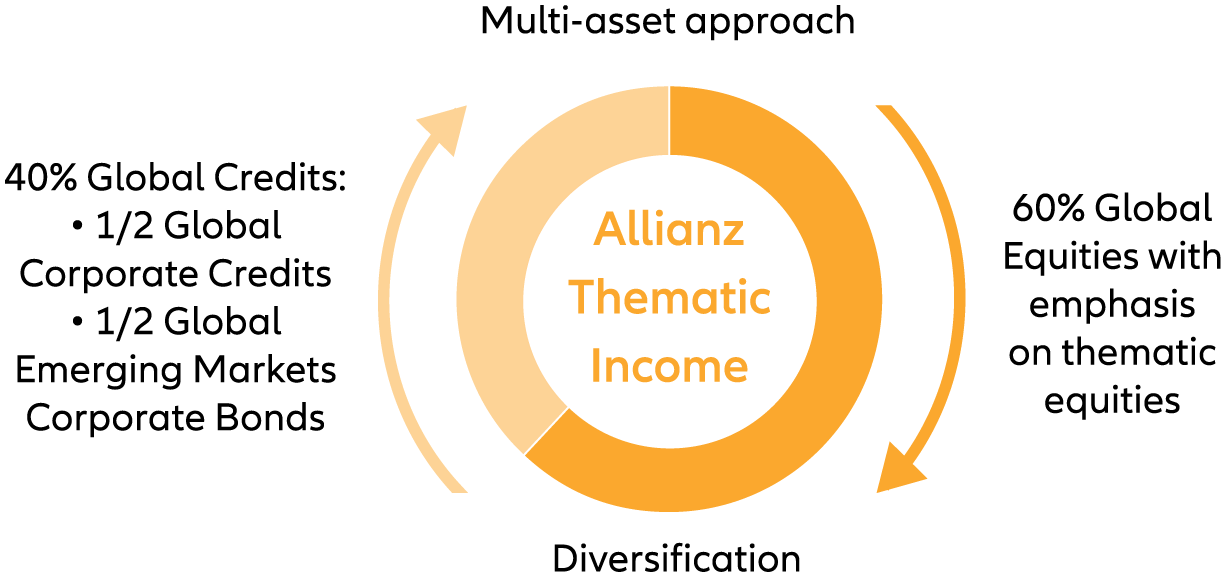

- The Fund aims at income and long-term capital appreciation by investing in global interest bearing securities and global equities with a focus on theme and stock selection.

- The Fund is exposed to significant risks which include investment/general market, thematic concentration, thematic-based investment strategy, asset allocation, emerging market, company-specific, creditworthiness/credit rating/downgrading, interest rate changes, default, volatility and liquidity, valuation, and currency (such as exchange controls, in particular RMB), and the adverse impact on RMB share classes due to currency depreciation.

- The Fund may invest in financial derivative instruments (“FDI”) which may expose the Fund to higher leverage, counterparty, liquidity, valuation, volatility, market and over the counter transaction risks. The use of derivatives may result in losses to the Fund which are greater than the amount originally invested. The Fund’s net derivative exposure may be up to 50% of the Fund’s net asset value.

- This investment may involve risks that could result in loss of part or entire amount of investors’ investment.

- In making investment decisions, investors should not rely solely on this material.

6 investable themes

are influencing our daily life

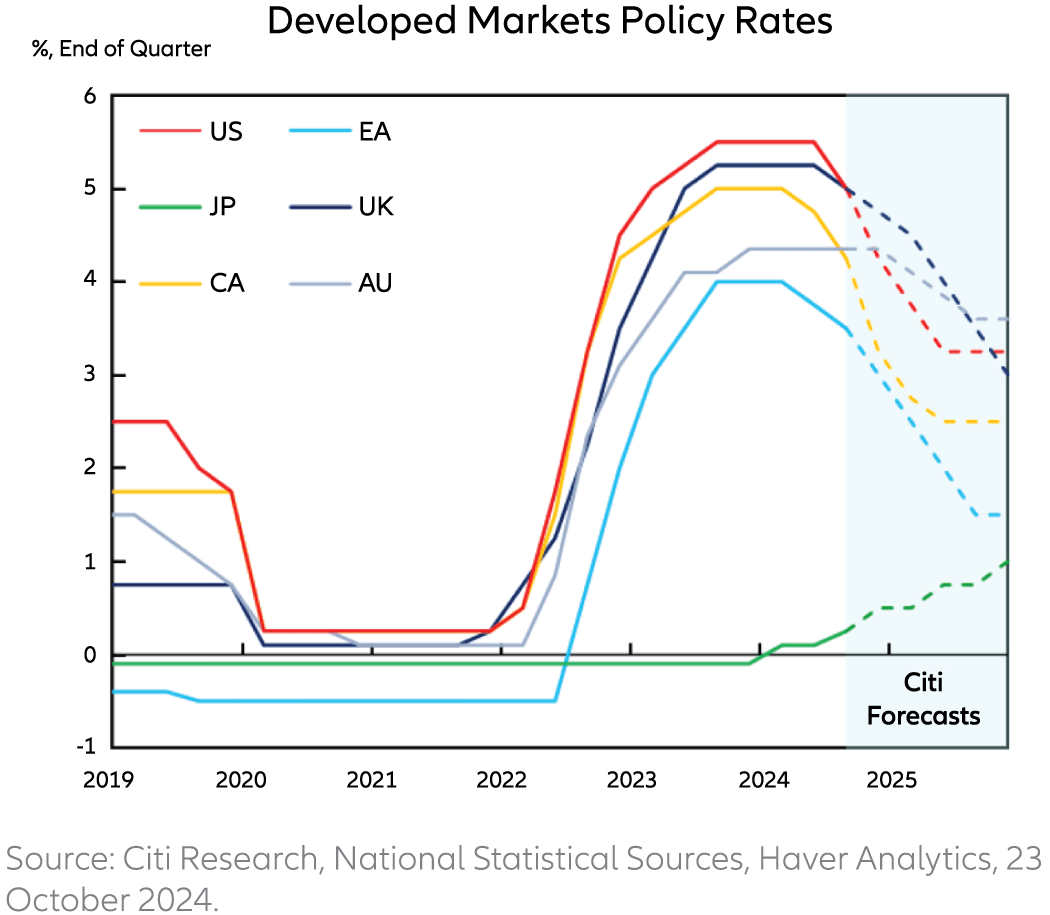

Global monetary policy across most of the developed markets are changing from tightening to easing. Therefore, global liquidity should ease, thus benefiting the capital market, in general.

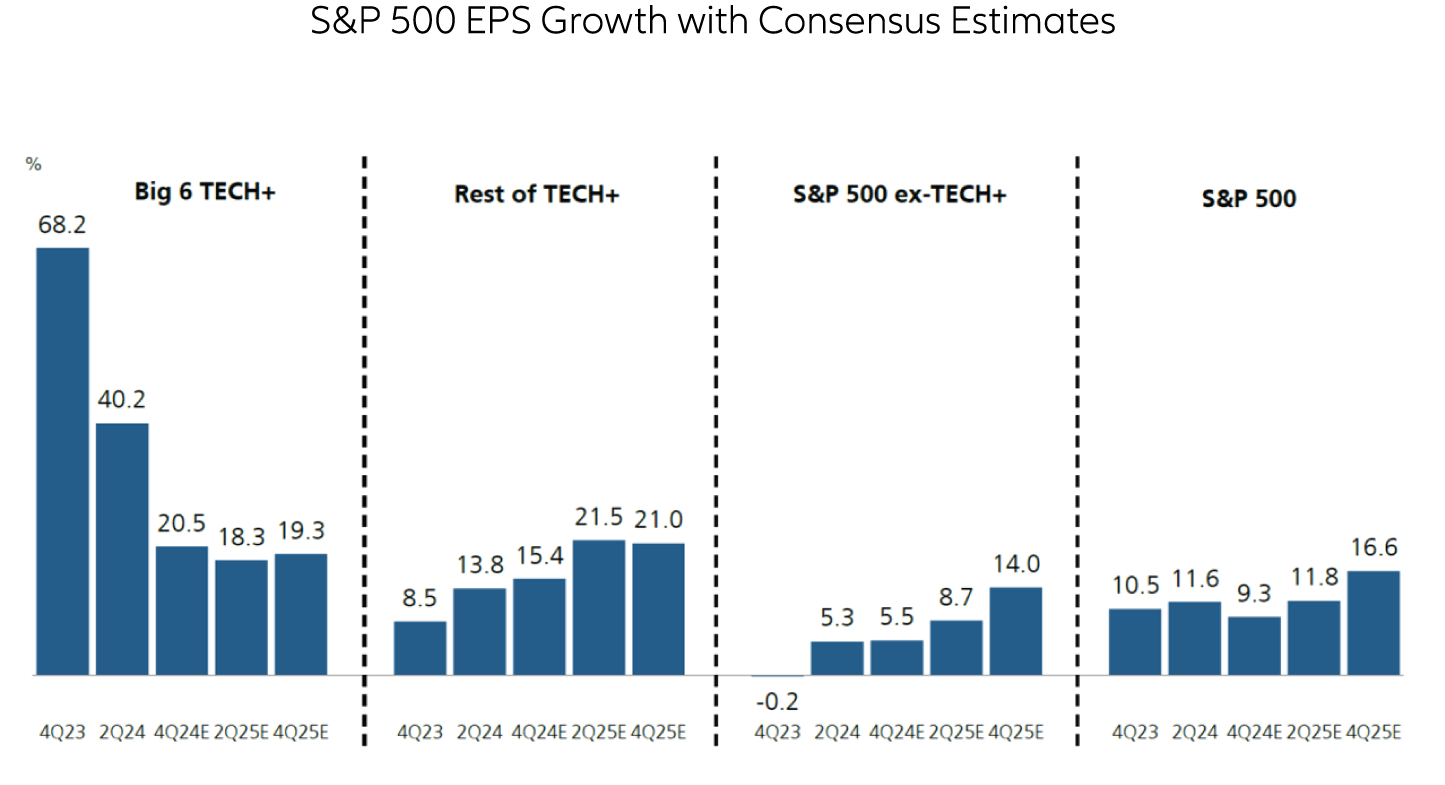

Earning growth from the Big Tech is expected to slow while earnings growth from the non- Big Tech companies are expected to increase. Therefore, we expect the share price of the non-tech companies should also improve in the coming quarters.

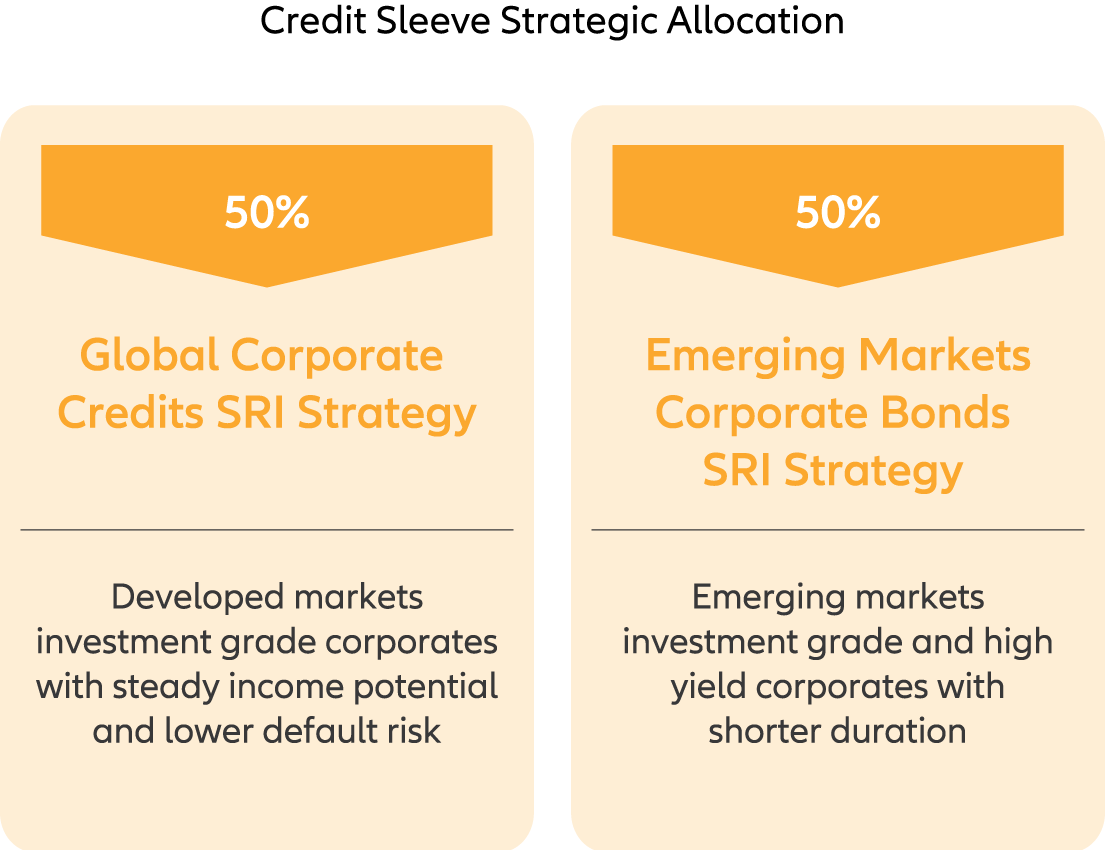

Both global corporate credits and global emerging markets corporate bonds sleeves screen companies, via our proprietary Socially Responsible Investment (SRI) process, for controversies which could impact future performance and excludes controversial businesses from its investment universe. This will help to improve portfolio quality and promote sustainability objectives and values.