Embracing Disruption

Who’s got the power?

Despite great and ongoing leaps in energy efficiency, power demand is set to show steady growth over the coming years and decades, after a long period of relative stability. The drivers of this change are manifold and complex, yet several key secular trends can be identified – electric vehicles (EVs), decarbonization, onshoring, and AI/datacentres. Taking a closer look at these trends is illuminative of changes in this developing market, also shedding light on what investors should expect over the coming years. Indeed, underestimating the likely growth in power demand is now raising its head as a significant potential risk.

Yet this growth in power demand is coming alongside the imperative to decarbonize, as well as the need to reconfigure power supply infrastructure to account for changing patters of energy supply and usage. The resulting tension – and how it is resolved through the actions of both corporates and policy makers – will have significant implications the highest consumers of power and the development of the burgeoning AI and datacentre sectors.

New demand drivers

The outlooks for power demand in the US and Europe show a relatively similar picture, with growth predicted at around 2-3 percent per year over the next 10 to 15 years. This pace may not look or sound dramatic, but it actually represents a quite remarkable development. Due to a combination of deindustrialization, slowing popular growth, and great leaps in energy efficiency, power demand has been essentially flat in the US for several decades, while even dropping slightly in Europe. So even moving into a growth phase is significant in itself.

Four key secular trends are changing the demand outlook. The sudden prevalence of electric vehicles (EVs) on the streets of our towns and cities is a clear sign of things to come, and EVs alone are expected to be a huge contributor to growing power demand, in the short-term and beyond.

Exhibit 1a: US power demand (GWh)

Source: Goldman Sach Investment Research, 2024

Exhibit 1b: European power demand (GWh)

Source: Goldman Sach Investment Research, 2024

Case study: Focus on Europe

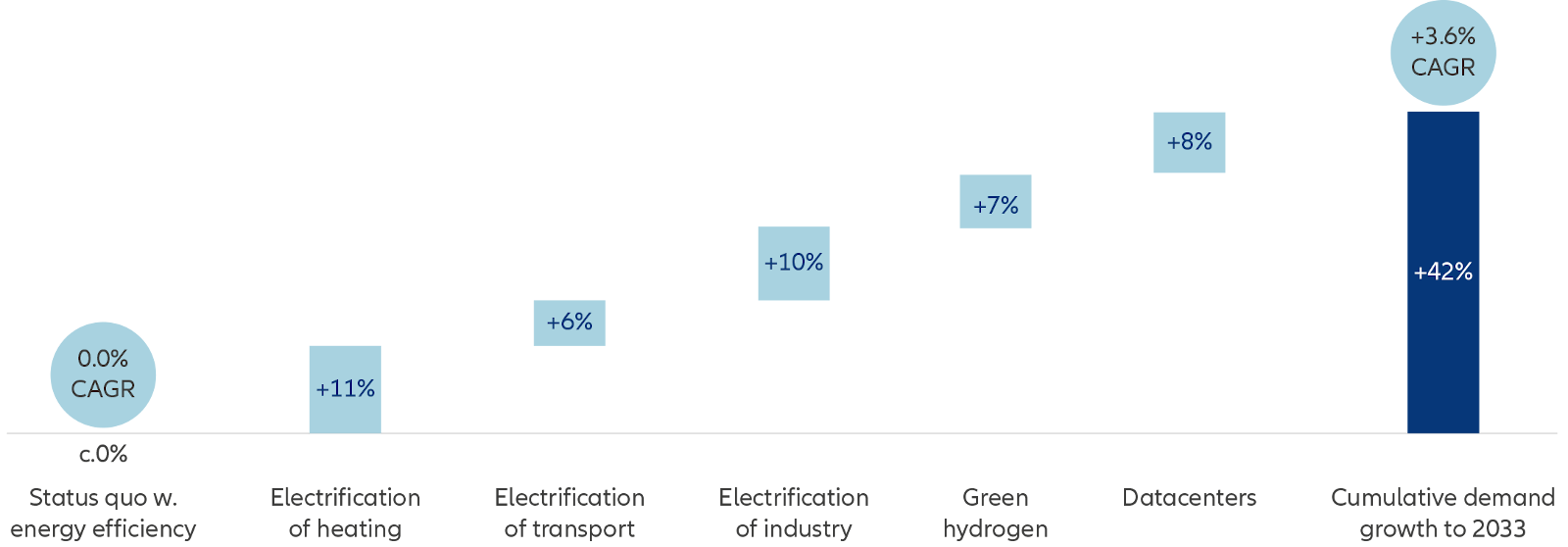

Europe can serve as a case study of the broader trends at work. Overall, power demand in Europe is set to soar in the coming decade, with a recent report predicting cumulative growth of 42% by 2033 – a CAGR of around 3.6%, very much at the bullish end of the possible scenarios depicted above.

Exhibit 2: We expect c.40% cumulative growth in power consumption, over the coming ten years (base case)

Europe cumulative power demand growth between 2023 and 2033E (%, bars) and CAGR (bubbles)

Datacentres include AI

Source: Goldman Sachs Global Investment Research, 2024.

Yet there is good reason to think that even these may be underestimates. For instance, the 10% growth attributed here to the electrification of industry includes only a very small part of the potential – and the EU’s 2030 targets suggest the actual impact will be much higher. For instance, full de -carbonization of Germany’s 40 million ton per year steel industry would represent an additional demand of 180TWh, while the whole of Germany only consumed 514TWh last year.

Digging, first, a little deeper into EV power demand, growth in Europe is likely to strongly outstrip the US, with the most bullish estimates currently suggesting EV use will provide 7% of all power demand in Europe by 2035 – up from around 1% in 2023. And despite some potential demand dampers – such as the declining number of miles driven annually and the growing efficiency of the vehicles themselves – the effects of these vehicles may be even more pronounced. Of course, as with many issues linked to energy transition, the impact of regulators and public policy makers will be profound in terms of shaping the future growth trajectory here – how sustained the political will to quickly phase out petrol and diesel cars remains, is one example here.

In terms of decarbonization, the Agora institute estimates that European Union decarbonization targets represent at additional 1,300TWh of electricity demand by 2030 from industry alone – not including the decarbonization of transport and domestic heating. Of course, several somewhat unpredictable factors such as carbon and electricity prices – as well as the impact of the EU’s Carbon Border Adjustment Mechanism – will affect actual outcomes, but the surge in demand will be considerable in any scenario.

Reshoring of industrial capacity has, so far, been less of a driver in Europe than the US. However, concerns around data sovereignty among both corporates and policy makers is certainly contributing to the growth of power demand from data centres, as the reshoring of data adds to secular growth trends such as the increasing proliferation of artificial intelligence. Growing populism in both the US and Europe, rising geopolitical tensions and the resulting increased protectionism and tariffs may be further drivers of the reshoring trend in the coming decade.

These trends are hitting Europe (but also, to different degrees, the US and China) as it is relatively advanced in its journey to phase out fossil fuels from electricity generation, with renewables reaching a 44% share in the EU 2023. Renewable power comes with its own challenges, in particular its intermittency, requiring different storage options to reduce price volatility. Grid investments have also not kept pace with the renewables build-out, and will require a significant stepup. California offers a cautionary tale in this respect: insufficient investments in the power infrastructure led to upward pressure on electricity prices, ultimately destroying some of the demand.

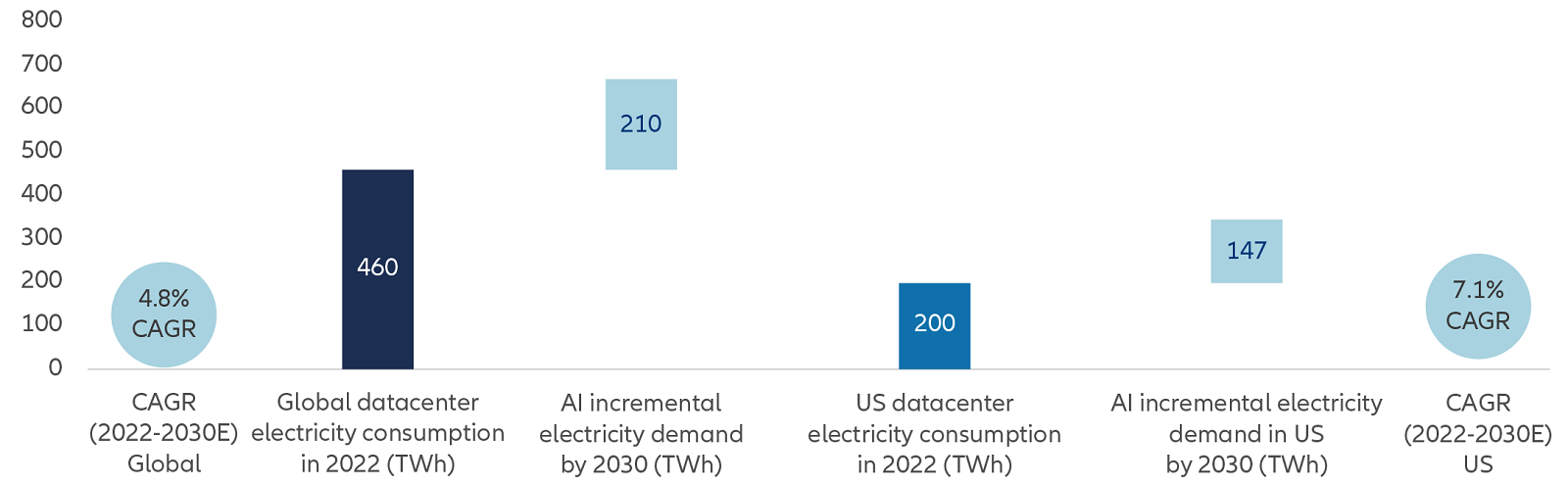

The AI effect

The effect of, and concerns about, the power implications of increasing AI usage are not new. Yet the projected power demands of these technologies remain staggering. And this comes despite impressive leaps in efficiency. For instance, the latest generation of AI racks from one manufacturer offer 45 times the performance of the previous generation, while only consuming 10 times the power. In practical terms, this means training a model such as ChatGPT4 – which has around 10 times the parameters of its predecessor, ChatGPT3 – can now be done for around 25% of the power consumption to previously.

Efficiency gains are also coming in other areas. For instance, we are now seeing greater deployment of more specialized and focused AI tools, often “SLMs” – small language models – where appropriate, something that may ease potential power demands from data centres. In addition, we are also seeing a move from vendors to encourage “on-device” AI inferencing, thus potentially further reducing the load on data centres.

Nevertheless, regardless of efficiency gains, we are certainly set to see a strong and steady increase in power demands from AI and related applications, as well as the data centres underpinning them.

Exhibit 3: AI power demand growth

This incremental electricity demand would reflect a ~5% CAGR from Global Datacenter demand and ~7% CAGR from US Datacenter demand

Source: HSBC, as of 24 July 2024.

Indeed, on the estimate above, a global CAGR of around 5% in electricity demand attributed to these technologies is expected over the coming decade, with US predicted to exceed this at around 7%.

Conclusion

The coincidence of surging power demand – driven in significant part by industrial decarbonization projects, increasing share of electric vehicles and AI adoption – with the need to decarbonize the sources of this power is producing a tension that may lead to unexpected volatility as the ability to produce and distribute efficiently grows in importance for both private and sovereign players. Concerns about future supply are leading some tech firms to move beyond their core competencies into the power supply and distribution sectors in an effort to guarantee steady future power supply.

Indeed, the key risk is that the expected growth in power demand is currently being underestimated. The winners here are likely to be those companies that are prepared for contingencies, but also driving efficiency themselves in terms of their core business – the incredible gains made in terms of the reduced power demands of AI chips is one example of rapid progress here. For investors looking at tech, a corporate’s approach to power supply and infrastructure should certainly feature as a consideration of their future sustainability.

The public policy impact on shaping this sector in the coming years cannot be underestimated. How debates around issues such as phasing out the internal combustion engine, or the acceptability of nuclear and on onshore wind, are resolved will have a great deal of impact on both power supply and demand in the coming years.

Finally, the geopolitical implications are considerable. With tech becoming the focal point of major actors in a shifting world order, it is becoming apparent that maintaining tech advantages will depend on what may seem pedestrian considerations regarding energy infrastructure, production and security. A shift in national focus towards these areas is therefore likely in the major economies, with larger investments, as well as tighter government control and regulation to be expected.