Mid-year outlook: China’s path out of its perfect storm

Summary

China’s long-term growth trajectory has been derailed by several challenges in recent months, but the government response and the country’s economic momentum should help it find a way through these setbacks.

Key takeaways

|

China has recently faced a perfect storm of challenges – both domestic and global – which it must overcome if it is to continue its trajectory towards becoming the biggest economy in the world. Yet historically, these periods of market turbulence have often turned out to present buying opportunities for investors. Our view is that this time China has built the momentum to help it deal with these setbacks, and these short-term challenges should not derail its long-term upward trend

Navigating the perfect storm

China’s “perfect storm” incorporates a combination of factors that have arisen simultaneously:

- China seeking to maintain its zero-Covid policy in the face of the biggest Covid outbreak since the early days of pandemic

- Concern that the regulatory crackdown on China’s tech giants will continue, depressing the prospects of firms that have driven growth

- Fears that China might face Western sanctions if it is perceived to side with Russia over its invasion of Ukraine

- The US Securities Exchange Commission (SEC) indicating it would delist Chinese companies which had not complied with US laws relating to audit transparency

- Disappointment among investors in China that, while the government has committed to monetary and fiscal easing, this is not yet reflected in policy actions

The Chinese government has acted to quell uncertainty. Key spokespeople have addressed many of the perceived threats, for example insisting that there is good dialogue with US regulators on potential delisting of ADRs (American Depository Receipts). They also recognise the need for greater stimulus within China and imply that the worst of any regulatory intervention should now be over.

Other risk factors remain, however – including speculation that China may face Western sanctions given its reluctance to condemn the Russian government’s invasion of Ukraine. But we think ultimately China will be careful to tread a diplomatic tightrope. Its export markets in the US and EU – worth USD 1 trillion in 20211 – are worth much more to it than its relationship with Russia (USD 65 billion2).

As we reach the midpoint of 2022, we see four key ways in which China is facing down this perfect storm, and ensuring it remains positioned to continue its story of economic growth:

1. Phase 3 of China’s development as a global power

China is at a critical point in its development. A key facet of what we call Phase 3 of China’s transformation – its establishment as a global power and development of diplomatic powers – will be its use of “soft” power to complement its economic strength. This is a delicate balancing act, but it will be critical to global stability over the next decade.

China’s Phase 3 also involves a shift in domestic focus as the country targets improved social equality to help support growth. Already, most Chinese firms still have a stronger domestic focus: around 90% of Chinese-listed companies’ revenues come from within China3. As a wider number of Chinese citizens enjoy greater spending power, it should help shield the country’s equity markets from the impact of broader geopolitical instability.

2. China’s post-Covid landscape

China was quick to apply a zero-Covid policy and, in the early days of the outbreak, the country looked like it would succeed in being first out of the pandemic. However, China responded to recent outbreaks of the Omicron variant by reverting to the restrictive approach it adopted in the early days of the pandemic. The lockdown in Shanghai alone affected 26 million people, causing significant disruptions to economic activity and curbing consumer spending. The impact also rippled outwards to impact local and global supply chains, limiting exports through Shanghai’s busy harbour.

While there are signs that the government could soften its zero-Covid stance to focus on a policy of “frequent mass testing”, a full opening up seems unlikely until much later in the year, or into 2023. In the short term, ongoing Covid outbreaks will likely still affect economic activity, although not to the extent of the first half of this year.

Although the GDP target of around 5.5%4 seems out of reach, nonetheless China is determined to restore economic momentum ahead of the important National Party Congress which will be held in the fourth quarter. President Xi will likely take the opportunity to highlight the overall data on Covid, which shows that the country registered fewer than 6,000 deaths while the US and Europe have each suffered over 1 million.5

3. Easing of government intervention

Many Chinese stocks recently suffered because of twin threats: government intervention in the tech sector, and threats from the SEC to delist Chinese companies that fail to meet US auditing standards by 2024. Around 280 Chinese companies listed on US exchanges could potentially be affected, including several big-name tech stocks.

But recently, China’s Politburo (the country’s top decision-making body) has announced plans to step up policy support, specifically for China’s internet sector. Authorities may also allow Chinese companies to provide the access to audits that the SEC requires, which could potentially stave off the worst of the threat from the SEC’s stance. Markets in China have been quick to respond positively, including a rebound in tech stocks.

The government’s relaxation of interventionist policy followed various easing measures already put in place this year. We have seen cuts to interest rates and the reserve ratio requirement (the level of liabilities that banks must hold), an easing of property curbs and an uptick in infrastructure spending. As Exhibit 1 shows, with banks being encouraged to expand loan growth, China’s credit impulse index – typically a leading indicator for future economic activity – has already started to recover.

Exhibit 1: China Impulse Index and MSCI China trailing 12 month EPS growth (%)

Source: Allianz Global Investors, Bloomberg, as at 31 May 2022.

4. Ensuring economic momentum is sustained

Domestic policy will likely prove the key influence on Chinese equities going forward. The government has previously ensured that underlying economic momentum is strong before taking steps to tackle underlying structural issues.

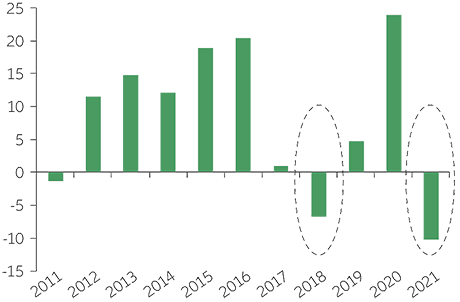

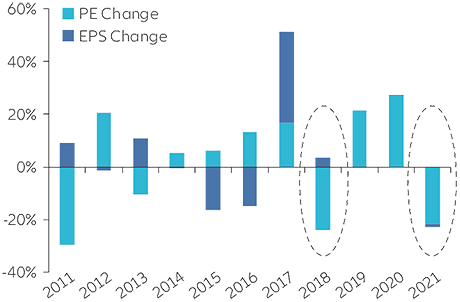

There are parallels between the recent policy and market experience and that of 2018. Exhibit 2 highlights the changes in the debt to GDP ratio and P/E (price to earnings) ratio in Chinese firms. 2018 saw a tightening of policy as China clamped down on leverage in the shadow banking sector, resulting in a major derating. But a subsequent easing of policy led to valuations recovering and Chinese equities’ growth story continuing.

Again, 2021 saw another tightening of policy due to a clampdown on leverage, this time in the property sector. But we are starting to see a return to a more market-friendly policy setting, as China loosens monetary policy as most of the rest of the world tightens policy. This should be positive for China, as is evidenced by the recent stabilisation of A-shares performance. We anticipate that a recovery in economic momentum in the second half of 2022 should also be supportive for equity valuations as confidence returns.

Exhibit 2: China equities typically track domestic credit cycle closely

China – change in debt to GDP ratio

MSCI China return breakdown– earnings revisions vs valuation change

Source: Bloomberg, Allianz Global Investors, as at 31 March 2022. Based on forward 12 months PE and EPS Changes. The information above is provided for illustrative purposes only, it should not be considered a recommendation to purchase or sell any particular security or strategy or an investment advice. Past performance, or any prediction, projection or forecast, is not indicative of future performance. The above represents the current opinions of AllianzGI and/or its affiliates and is subject to change without notice. No assumption should be made that any specific action will be taken with respect to portfolios we manage. No investment advice or recommendation is provided, and no offer is made to buy or sell any security, strategy or investment product. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Forecasts are inherently limited and should not be relied upon as an indicator of future results.

Think thematically for growth

China’s long-term economic growth is likely to be underpinned by broad demographic, social and industrial trends in the country. And investors could capture these in thematic investment strategies that may complement core A-shares portfolios. For example, the Chinese government’s strategic focus on self-sufficiency as it bids to deliver the tech infrastructure to underpin the country’s projected growth may lead to opportunities in a range of industries, such as renewables, semiconductors and 5G.

We expect this self-sufficiency to contribute to the ongoing improvement in quality of Chinese manufacturing, particularly through the enhanced use of robotics. More efficient and effective manufacturing processes may in turn help enable Chinese companies to win market share from foreign competitors, domestically and overseas.

Elsewhere, a social shift in China could present some interesting stories for investors. Increased affluence among the Chinese public has seen a lifestyle evolution as consumers prioritise health and wellbeing. China has a long track record of pioneering medicine and healthcare going back thousands of years. This history is already translating into a burgeoning medical technology industry within China. More widely, the healthy lifestyle theme is further supported by growing demand for health-focused consumer products.

Other thematic approaches could include renewable energy, while solar power and electric vehicles may benefit from the government’s pledge to be carbon neutral by 2060, with CO2 emissions peaking in 2030.

In addition, the financial reforms and ongoing liberalisation of China’s capital markets may also benefit some companies in the financial services sector.

Be alert: higher yields often come with higher volatility

So far in the 21st century, Chinese equities have outperformed their European equivalents. As Exhibit 3 shows, returns from Chinese stocks have been about twice those of their European peers since 2000. But investors must accept that in China, higher yields come with higher volatility, and the chart also highlights several short-term periods of decline, like the one we have seen over much of the last year.

Exhibit 3: MSCI China vs S&P500 & MSCI Europe Index – total return since 2000 (USD, rebased to 100)

Source: Refinitiv Datastream, Allianz Global Investors, as at 3 June 2022. Based on total return performance in gross, USD from 31 Dec 2000. Past performance is not indicative of future results. Investors may not invest directly in an index.”.

It is clear that China’s “perfect storm” weighed on the country’s markets in late 2021 – and has continued to impact into 2022. But the Chinese government has already been clear in its response, and we expect further policy easing in coming months.

Historically, extreme periods of volatility in China’s equity markets have presented some long-term buying opportunities. Many stocks appear to have come back to valuation levels that we believe offer good long-term risk/reward potential.

China’s path to becoming the world’s largest economy remains intact. As we look to the rest of the year and beyond, the individual company stories that are driving broader growth should present opportunities for those investors with the local expertise and on-the-ground knowledge to identify them.

1 US Census Bureau, Eurostat

2 Reuters, 1 March, 2022

3 Morgan Stanley – Asia Quantitative strategy global exposure guide as at 31 Dec, 2021

4 Bloomberg, 5 March 2022

5 Our World in Data, 9 June 2022

Information herein is based on sources we believe to be accurate and reliable as at the d ate it was made. We reserve the right to revise any information herein at any time without notice. No offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. In making investment decisions, investors should not rely solely on this material but should seek independent professional advice. However, if you choose not to seek professional advice, you should consider the suitability of the product for yourself. Investment involves risks including the possible loss of principal amount invested and risks associated with investment in emerging and less developed markets. Past performance of the fund manager(s), or any prediction, projection or forecast, is not indicative of future performance. This material has not been reviewed by any regulatory authorities.

Active Ownership Creates Long Term Investment Value

Summary

Crossing out companies with negative ESG (Environment, Social and Governance) performance from an investment checklist has long been a commonly adopted rule in sustainable investment. The market’s definition of “sin stocks” has also extended from firms involved in the arms trade, tobacco and alcohol to the fossil fuel industry.