Embracing Disruption

Eight compass points to find your bearings in the Year of the Snake

While the calendar may already show 2025, for investors the new year will only truly start later in January. On 20 January, Donald Trump will be inaugurated as the 47th President of the United States of America and implement his “America First” agenda. A few days later, on 29 January, large swathes of East Asia will come to a standstill as people celebrate the Lunar New Year and usher in the Year of the Snake. 2025 promises to be a year where investors will need to keep their eyes on both Beijing and Mar-a-Lago – and potentially on more outlying places, too, such as Greenland or Panama.

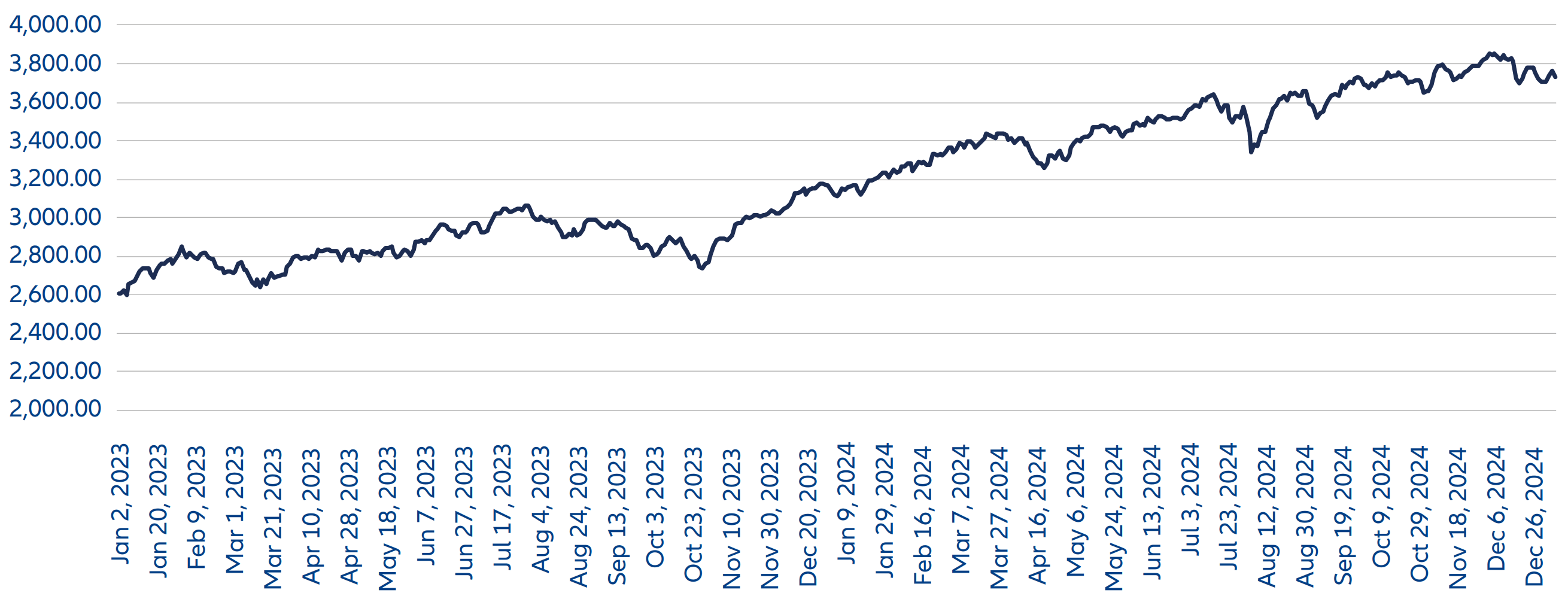

After two years of solid market performance (see Chart 1), we remain optimistic about global equities but are mindful of potential air pockets in investors’ flight paths. To navigate the Year of the Snake, we offer the following compass points to investors:

- Anchor portfolios: Volatility and geopolitics will take centre stage under an America First agenda. For equity investors, this commends a relatively diversified posture in terms of geographies and sectors. US exceptionalism (in terms of both economic growth and corporate earnings) is still the dominant feature of global markets, but valuation gaps versus other regions (in particular Europe and China) have widened and can open up opportunities.

- Focus on margins: Donald Trump’s America First agenda and his planned new tariffs will disrupt global trade. But the details of these tariffs will be critical to evaluate their impact on earnings and the ability for firms to absorb some of the costs via margin or currency. The key here will be to understand if components imported from China (in particular) – in contrast with finished goods – will also be included in the new US tariff policy.

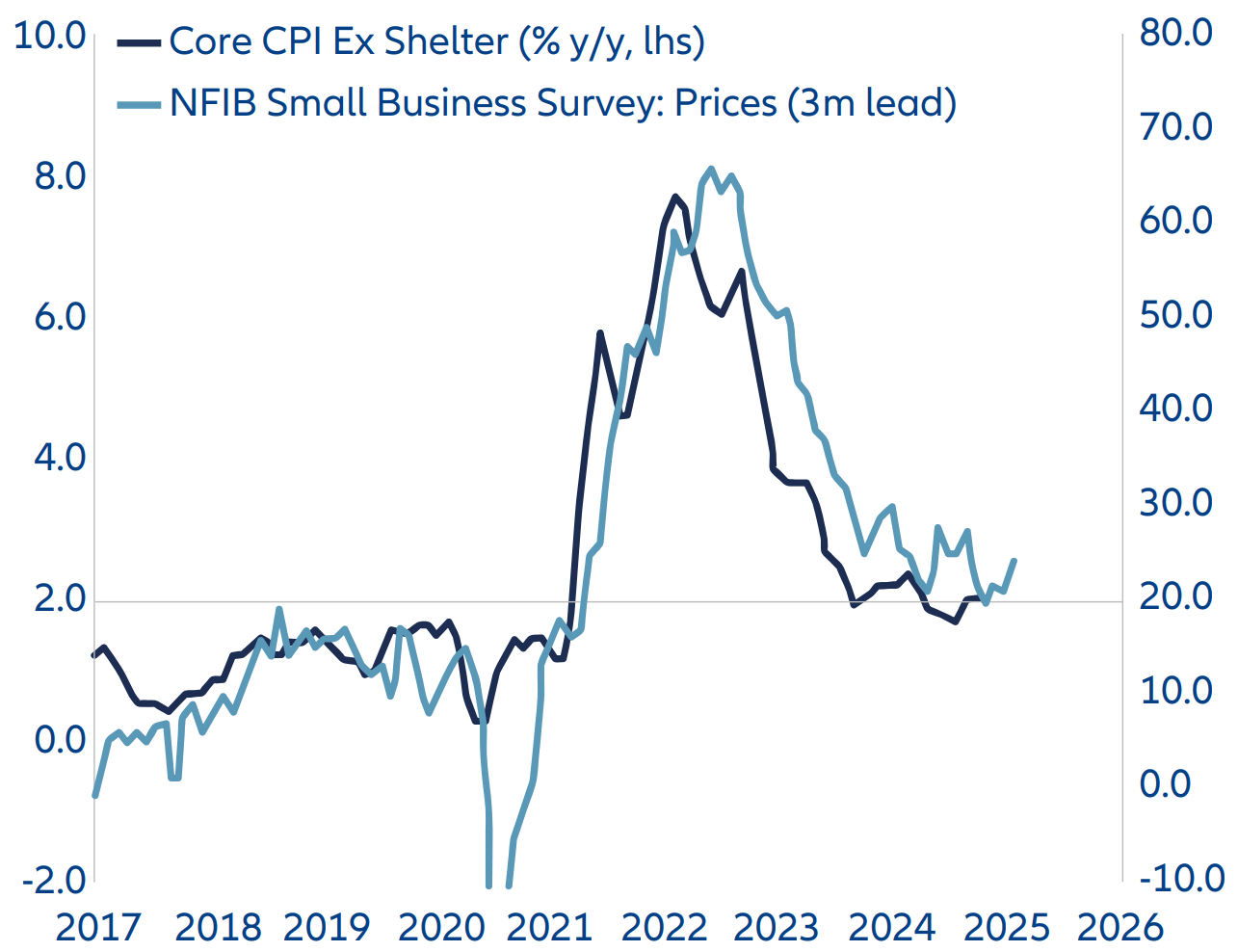

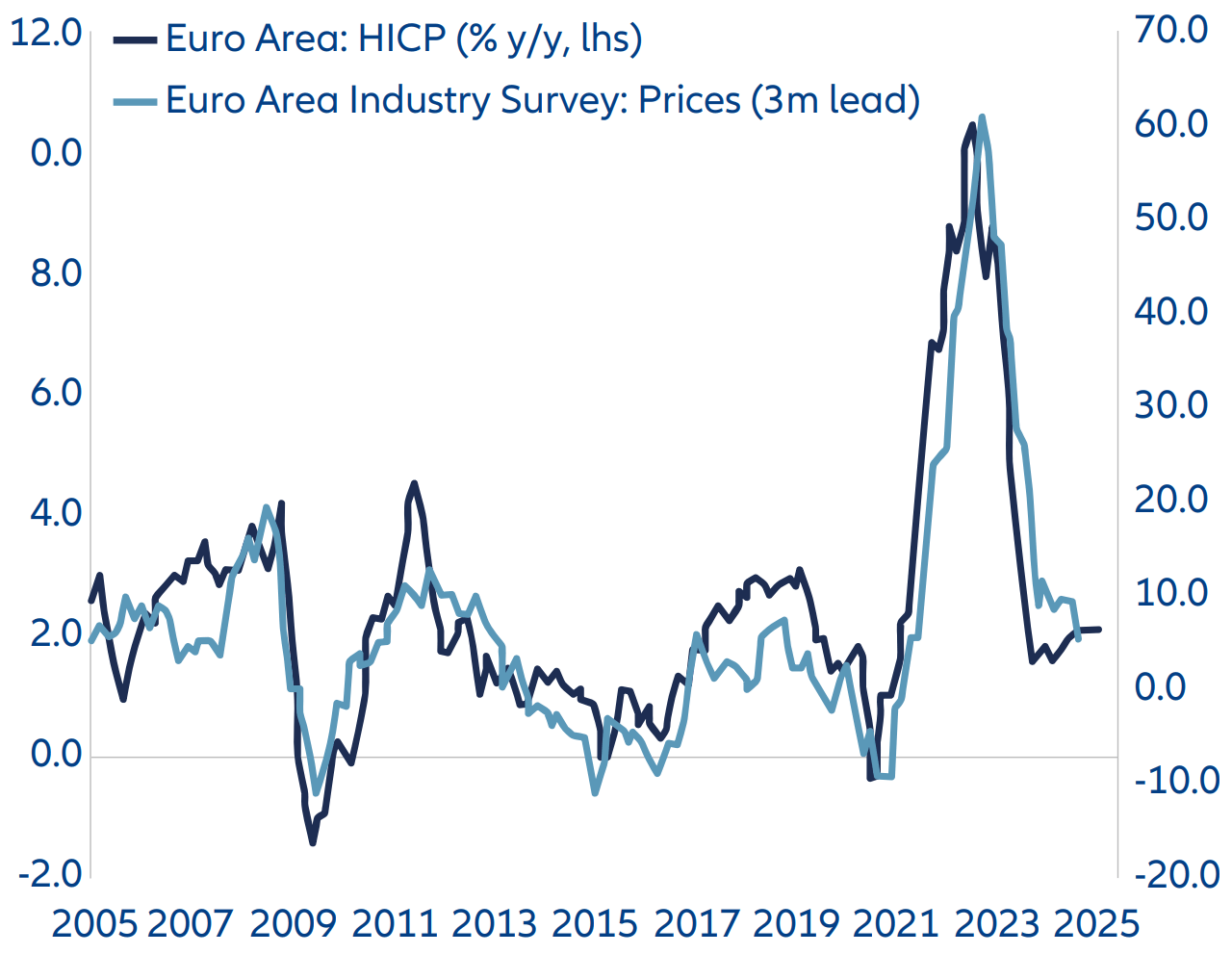

- New paradigm for inflation: Inflation has come down significantly (see Chart 2) compared to the fiscal sugar rush of the Covid years. But central bankers may have to pore longer over their spreadsheets, as resilient economies and tariffs impact inflation and the potential for rate cuts. As tariffs bite harder in some parts of the world than others, more divergence in central bank policy could be the result. Currencies are due to become a major adjustment tool.

- Defence spending resurgent: 2.5%? 3% 5%? Whatever number Donald Trump and his NATO allies end up agreeing on in terms of defence spending as percentage of GDP, it is clear that it will be higher than current figures. Other nations will follow suit. Fiscal gymnastics will be required by governments with already strained budgets. The wars in Ukraine and the Middle East have shown that the beneficiaries are likely to be found in tech, and not in the traditional military equipment sector.

- Stock picking more critical than ever: While many investors navigated 2023 and 2024 under cruise control, benefiting from the performance of the so-called Magnificent Seven mega-caps, 2025 is likely to require a more hands-on approach. We believe that global markets are “fairly valued” overall, but market concentration and geopolitical fault lines make sound financial analysis at the individual stock level imperative again. Valuation and earnings power will be key metrics to identifying the most promising stocks across the globe.

- Don’t neglect China: If US equity investors can look back on the past two years with satisfaction, Chinese equity investors have been less happy. Whether 2025 will be brighter depends on the reaction from China to the new policy regime in the US – and, notably, tariffs will be key. On the domestic front, there are signs that the property sector is bottoming and we see some revival of consumer demand following specific government-led policies. The reaction from China to Trump 2.0 might surprise many for this underowned market.

- Digital Darwinism and AI: As AI propagates through the global economy, 2025 will be a year where it is key to broaden exposure to this theme. Investors need to look beyond the big names and include AI infrastructure, as well as AI solutions and services segments, in their allocations. These may be found not only in the US, but also in other parts of the world. At the same time, firms bound to be disrupted by the broader adoption of AI may lose their places in investors’ portfolios.

- The new face of geopolitics: Expect the unexpected. Policy changes will be announced via posts on social media. Diplomatic tussles will erupt over seemingly settled issues (the Panama canal) or thinly inhabited places (Greenland). Allies will wash their dirty laundry in public, while proxy wars – of the economic or even military sort - may erupt and entangle major powers. In 2025, investors will need to keep their nerve as geopolitics moves from the stately pace of international conferences and state banquets to the frenetic ping of social media notifications.

In the Chinese zodiac, the Snake is characterised by wisdom. In 2025, investors will need to heed the ancient wisdoms of portfolio construction, focusing on the fundamentals, diversifying, and keeping their nerve. Our eight compass points should help them find their bearings in a year that promises to be all but boring.

Chart 1: Performance MSCI World (USD) – Jan 2023 to Dec 2024

Source: Bloomberg, January 2025

Chart 2a: US inflation ex-Shelter has been at 2% for a while

Source: BNP Paribas Exane, December 2024

Chart 2b: EU headline: likely to remain subdued

Source: BNP Paribas Exane, December 2024